As we step into 2026, consumers preparing to purchase their next smartphone, laptop, or smart home device face an unexpected reality: the artificial intelligence revolution is making consumer electronics more expensive. The unprecedented demand for AI-capable chips is creating ripple effects throughout the entire technology supply chain, forcing manufacturers to pass increased costs onto consumers. Understanding these dynamics is crucial for anyone planning significant tech purchases in the coming year, as the pricing landscape for consumer electronics is undergoing its most significant shift in recent memory.

The Root Cause: AI Chip Demand Outpaces Supply

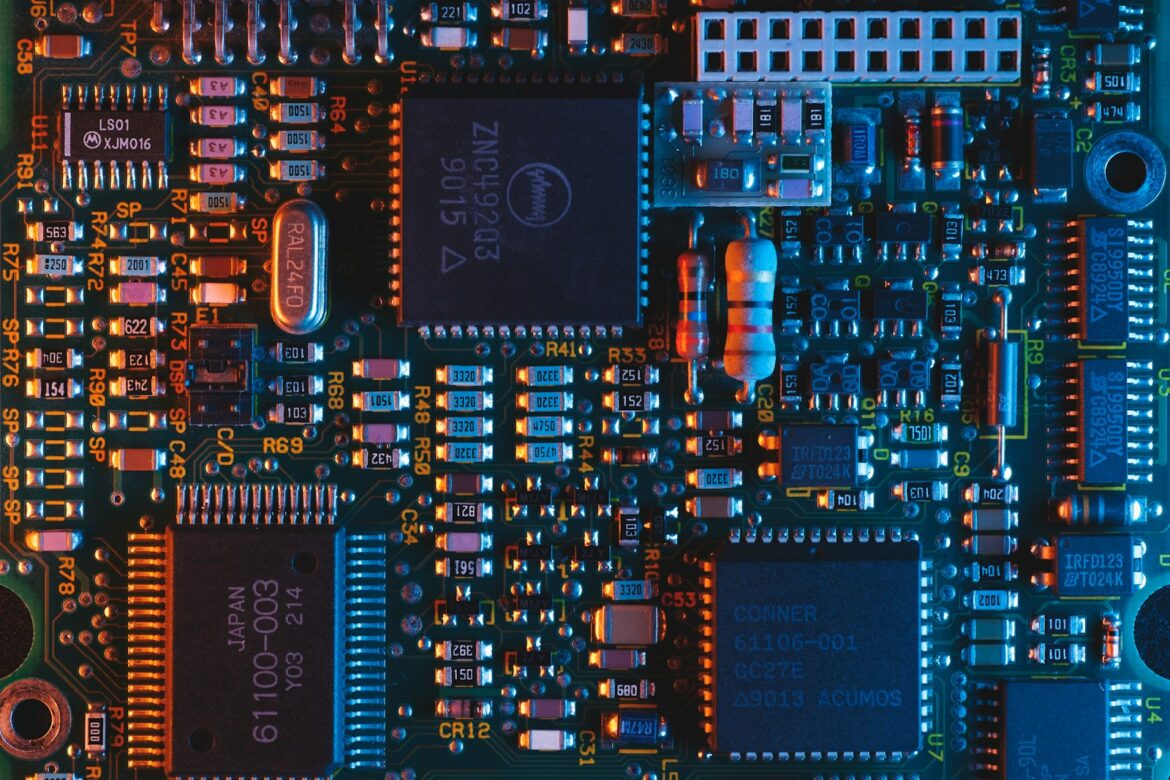

The explosion in artificial intelligence applications has created insatiable demand for specialized chips capable of handling AI workloads efficiently. From smartphones that process images using neural networks to laptops that accelerate video editing with machine learning to smart home devices that understand natural language locally, AI functionality has transitioned from novelty to necessity in remarkably short order.

This transformation has placed enormous pressure on semiconductor manufacturers. Companies like TSMC, Samsung Foundry, and Intel are racing to expand production capacity, but building new fabrication facilities requires billions of dollars in investment and years of construction time. The semiconductor industry operates on long planning cycles, and the explosive growth in AI demand has caught even the most forward-thinking manufacturers somewhat unprepared.

The situation is further complicated by the technical requirements of AI chips. These processors require advanced manufacturing processes, typically using cutting-edge 5-nanometer or 3-nanometer production nodes. These sophisticated processes deliver higher performance and better power efficiency but come with dramatically higher production costs. The combination of limited capacity and expensive manufacturing creates a perfect storm for price increases.

Major Players and Market Dynamics

Nvidia’s reported twenty billion dollar acquisition of Groq represents just one example of the massive investments flowing into AI chip development. Nvidia has emerged as the dominant player in AI computing, with its graphics processors proving remarkably well-suited for training and running AI models. The company’s market valuation has soared as demand for its products has exceeded supply, leading to allocation challenges and long wait times for customers.

Qualcomm’s expansion into laptop processors with its Snapdragon X2 Elite and X2 Elite Premium chips demonstrates how traditional mobile chip manufacturers are adapting to the AI era. These processors integrate dedicated AI accelerators alongside traditional CPU and GPU components, enabling sophisticated on-device AI capabilities without requiring constant cloud connectivity. However, the additional complexity and silicon area required for these AI features contribute to higher manufacturing costs.

Apple, while not always discussed in the context of AI chips, has been integrating neural processing capabilities into its processors for several years. The company’s vertical integration strategy allows it to absorb some cost increases more easily than competitors who purchase chips from third parties, potentially giving Apple a competitive advantage as prices rise across the industry.

Emerging companies like Groq are developing specialized AI processors that promise better performance and efficiency than traditional designs. However, these innovative architectures require significant research and development investment, further driving up costs in the near term. The acquisition of such companies by established players like Nvidia demonstrates the strategic value being placed on AI chip technology and expertise.

Direct Impact on Consumer Electronics Pricing

Industry analysts predict that the average smartphone price will increase by approximately five to ten percent in 2026 compared to 2025, with flagship devices seeing even steeper increases. A phone that would have cost eight hundred dollars in 2025 might carry a price tag of eight hundred fifty to nine hundred dollars in 2026, with the AI-capable processor representing a significant portion of that increase.

Laptops are experiencing similar pricing pressures. The integration of powerful AI accelerators into laptop processors enables impressive capabilities like real-time video upscaling, instant language translation, and sophisticated creative tools. However, these features come at a cost. Mid-range laptops that previously sold for seven hundred to eight hundred dollars may push toward the nine hundred to one thousand dollar range, while high-end professional laptops could easily exceed two thousand dollars as manufacturers add increasingly capable AI hardware.

Even seemingly simple devices like smart home cameras and speakers are affected. Modern smart home devices increasingly process voice commands and video analysis locally using AI rather than sending everything to cloud servers. This approach offers better privacy and faster response times but requires more sophisticated processors in each device. A smart security camera that cost one hundred fifty dollars in 2024 might cost one hundred eighty to two hundred dollars in 2026, with much of that increase attributable to the more powerful AI-capable processor inside.

Tablets, smartwatches, and other connected devices face similar pressures. As consumers increasingly expect AI features across all their devices, manufacturers have little choice but to incorporate more expensive AI-capable chips, driving prices upward across entire product categories.

Secondary Effects: Memory and Storage Costs

The AI chip boom is also affecting memory and storage pricing, albeit indirectly. AI models require substantial amounts of fast memory to operate efficiently. This has increased demand for high-bandwidth memory technologies, which compete for the same manufacturing capacity as traditional DRAM. Additionally, AI features often require local storage of model weights and training data, driving demand for larger and faster storage solutions.

Smartphones that once came standard with 128GB of storage are increasingly offering 256GB or even 512GB as base configurations to accommodate AI features and the data they generate. While flash storage costs have generally declined over time, the rate of decline has slowed, and the need for higher-capacity configurations means consumers are paying more in absolute terms.

Manufacturing Capacity Constraints

The semiconductor manufacturing capacity crunch extends beyond just AI chips. When TSMC allocates more of its production capacity to high-margin AI processors, it necessarily has less capacity available for other chip types. This creates pressure across the entire supply chain, as manufacturers of everything from automotive chips to consumer electronics processors compete for limited foundry capacity.

The situation is further complicated by geopolitical factors. Efforts to diversify semiconductor manufacturing away from Taiwan and China, while strategically important, require massive capital investments and will take years to bear fruit. In the meantime, the industry must work within existing capacity constraints, which contributes to price inflation across the board.

Consumer Response and Market Adaptation

How are consumers likely to respond to these price increases? Historical patterns suggest several possible scenarios. Some consumers will simply absorb the higher costs, particularly for devices they consider essential. The smartphone market has demonstrated remarkable price inelasticity for flagship devices, with enthusiasts willing to pay premium prices for the latest technology.

Other consumers may extend their upgrade cycles, holding onto existing devices for longer periods rather than upgrading annually or every two years. This trend was already emerging before the current price increases and will likely accelerate. Modern smartphones and laptops are highly capable devices that remain useful for many years, making it easier for consumers to delay upgrades.

The mid-range and budget segments of the market may see increased competition and innovation as manufacturers work to offer AI features at lower price points. Companies that can efficiently integrate AI capabilities into more affordable devices will gain competitive advantages. We’re already seeing this with devices like the Redmi Note series and similar offerings that bring flagship-adjacent features to mid-range price points.

Strategies for Savvy Consumers

For consumers planning tech purchases in 2026, several strategies can help navigate the challenging pricing environment. First, carefully evaluate which AI features you actually need. Many devices tout impressive AI capabilities that most users rarely utilize. A mid-range device without cutting-edge AI might serve your needs perfectly well at a significantly lower cost.

Second, consider timing your purchases strategically. Tech prices typically decline as products age in their lifecycle. Buying a device three to six months after launch rather than immediately can yield significant savings, though you’ll need to balance this against your immediate needs.

Third, don’t overlook previous generation devices. Last year’s flagship often becomes this year’s excellent value proposition. A 2025 flagship device purchased in 2026 may cost hundreds of dollars less than the 2026 equivalent while still offering excellent performance and features.

Finally, consider refurbished or certified pre-owned devices. As environmental consciousness grows and manufacturers improve refurbishment programs, these options offer compelling value for budget-conscious consumers who don’t need the absolute latest technology.

Looking Ahead: When Will Prices Stabilize?

The semiconductor industry’s capacity expansion efforts will eventually alleviate current constraints, but this process takes time. New fabrication facilities typically require three to five years from groundbreaking to full production. Major investments announced in 2024 and 2025 won’t significantly impact supply until 2027 or 2028.

In the meantime, expect continued price pressure on consumer electronics throughout 2026 and likely into 2027. However, competition and manufacturing efficiency improvements should gradually moderate these increases. Additionally, as AI features become standardized rather than differentiating factors, the premium consumers pay specifically for AI capabilities should decrease.

The transition to more advanced manufacturing processes will eventually enable more cost-effective production of AI-capable chips. Each generation of manufacturing technology delivers better performance per dollar, though the initial costs are always high. As 3-nanometer and eventually 2-nanometer processes mature, the cost per transistor should decline, ultimately benefiting consumers.

Conclusion: Navigating the New Normal

The AI chip boom represents a fundamental shift in consumer electronics economics. While the resulting price increases are unwelcome news for consumers, they reflect the genuine costs of bringing powerful AI capabilities to everyday devices. These features aren’t just marketing fluff; they enable real capabilities that enhance user experiences in meaningful ways.

As we move through 2026, informed consumers who understand these dynamics will be better positioned to make smart purchasing decisions. Whether that means paying premium prices for cutting-edge AI features, seeking value in mid-range devices, or simply waiting for prices to moderate, knowledge of the underlying market forces empowers better choices. The AI revolution is here to stay, and while it’s making our devices more expensive in the short term, it’s also making them more capable than ever before. Understanding this trade-off is essential for anyone navigating the consumer electronics market in 2026 and beyond.